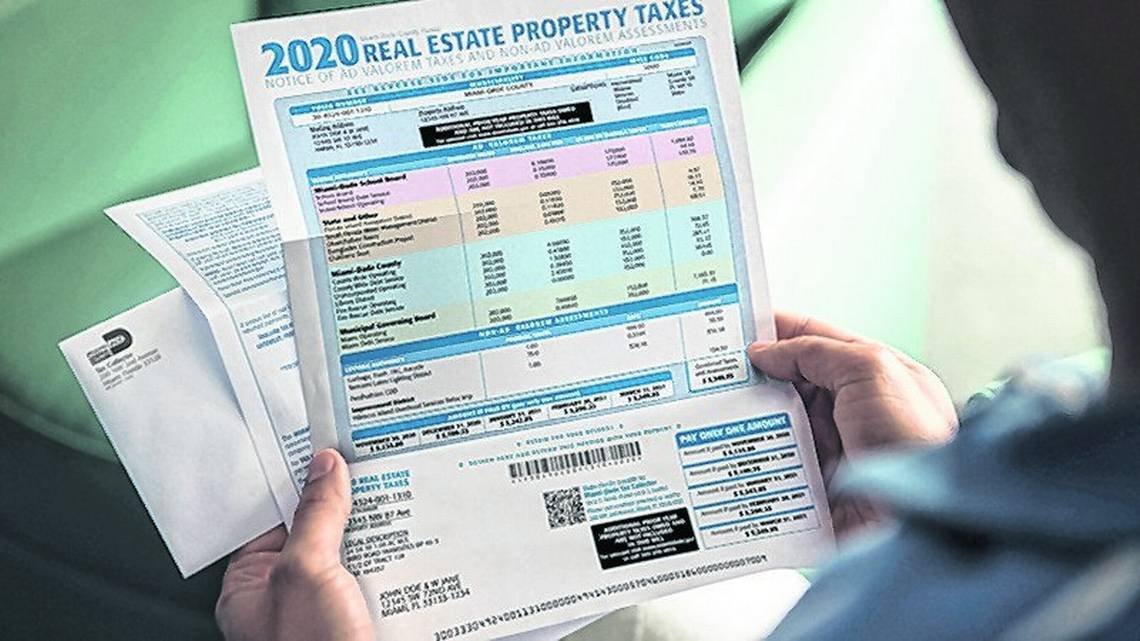

Tax Bill Too High? Here’s What You Can Do About it.

If your property tax notice landed recently and made your eyes widen — you’re not alone.

As home values continue to climb in Pembroke Pines, many homeowners are seeing higher assessments… and higher tax bills to match.

But here’s the part most people don’t realize:

You can challenge your property’s assessed value.

🔗 Read the article here:

👉 Read the Miami Herald article here

Why You Might Want to Appeal

Errors happen — incorrect square footage, phantom features (like a bathroom you don’t have), or outdated comps can inflate your value.

Recent purchases — if you bought your home for less than the assessed value, that could be strong evidence.

Uneven assessments — if similar homes nearby are valued lower, it’s worth a second look.

Here’s How It Works in Broward

Review your TRIM notice (Truth in Millage) carefully when it arrives.

Gather your evidence — sales data, comps, photos, or an appraisal.

File a petition with the Value Adjustment Board (VAB) — typically due by mid-September.

Pay the filing fee (about $15) and prep for your hearing, if it’s scheduled.

📎 Want the full story?

👉 Read the full Miami Herald article here

Need Help Valuing Your Home?

If you’re unsure how your home stacks up against recent sales or assessments, a local real estate agent can help you prepare a market-based valuation.

I do this often for homeowners looking to appeal — feel free to reach out if you’d like a second opinion or some guidance.

Bottom line:

If something feels off about your tax bill, you don’t have to just accept it.

A simple challenge — backed with the right info — could save you hundreds or more each year.

Check with the Broward County Property Appraiser’s office for deadlines and support, or talk to a property tax specialist if you want help navigating the process.

📞 Book a quick call with me and we’ll figure out what makes the most sense for you right now — no pitch, just real talk.