Head’s Up, West Pines

If you live west of I-75, don't be surprised if you hear a low hum in the early morning hours this weekend.

It’s not a drone, it’s Broward County targeting aggressive mosquitoes from the sky.

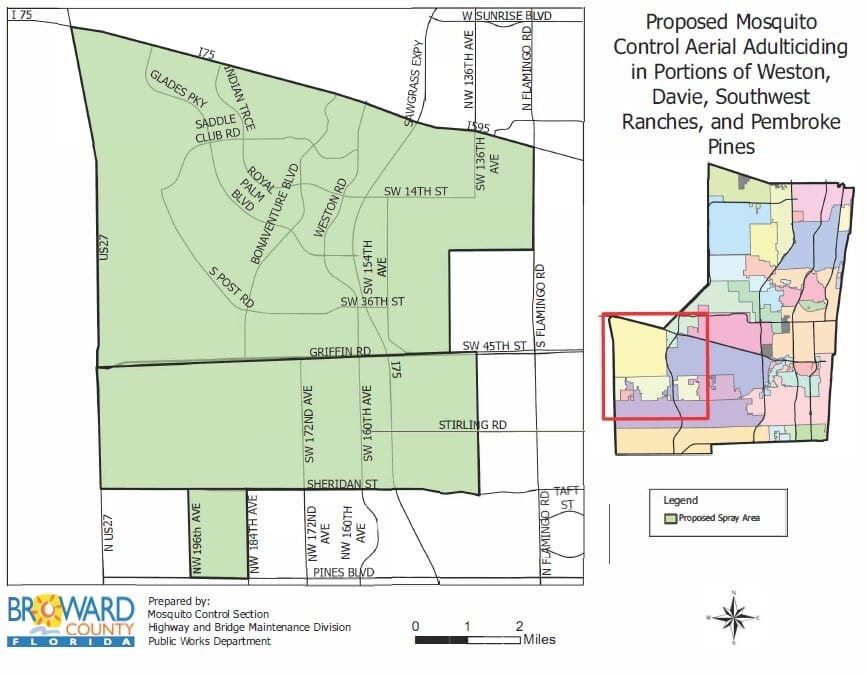

Due to a spike in service requests and mosquito surveillance data, aerial spraying will take place in Pembroke Pines, Weston, Southwest Ranches, and Davie on:

Saturday, July 12 and Monday, July 14

Between 2 AM and 6 AM (weather permitting)

The target?

Gallinippers: giant, aggressive mosquitoes that don’t spread disease but definitely bite hard.

If you have breathing sensitivities, stay inside with windows closed during those hours.

Residents registered for alerts will get notified before spraying starts.

Need a copy of the spray map, info on the insecticide, or how to sign up for notifications? Just hit reply and I’ll send it your way.

Takeaway:

This one’s more public safety than headline news, but it matters.

If you’re in the zone, reschedule that early dog walk and keep the house sealed tight.

Read the article here:

👉 Read the CNW article here

Map: Proposed spray zone covering parts of Pembroke Pines, Davie, and Southwest Ranches (via Broward County Mosquito Control).

Sheridan Village Sells in $15.5M Deal:

A major commercial property in Pembroke Pines just changed hands for the first time since it was built and it fetched a serious price.

Sheridan Village: Mixed-use site at 16602–16660 Sheridan Street, sold for $15.5M

Sheridan Village, the mixed-use complex at 16602–16660 Sheridan Street, sold for $15.53 million to Andrew Perkins (Perkins Realty Management).

The seller was Sheridan Real Estate Group.

Built in 2016, the property includes self-storage and ground-floor retail and sits in a high visibility location near Broward College, FIU’s North Campus, and the Regional Library.

The deal was brokered by Marcus & Millichap and included a $10.3M mortgage from Standard Insurance Corp, according to CRE-sources and The Real Deal.

Takeaway:

When local commercial properties like this move for eight figures, it’s a signal.

Investors are betting on Pines.

And mixed-use assets like this, self-storage with retail, are still pulling strong valuations.

Want the full story?

👉 Read the full CRE-Sources article here